Hello, Future Homeowners! This is Jury, your dedicated Kissimmee real estate agent, bringing you the latest scoop on what's happening in the Kissimmee real estate market. Whether you're actively searching for your dream home or just starting to set the stage for homeownership in 2024, this article is your go-to guide for understanding today's trends and preparing your home purchase strategy.

Exploring Your Options: The Kissimmee Market Snapshot

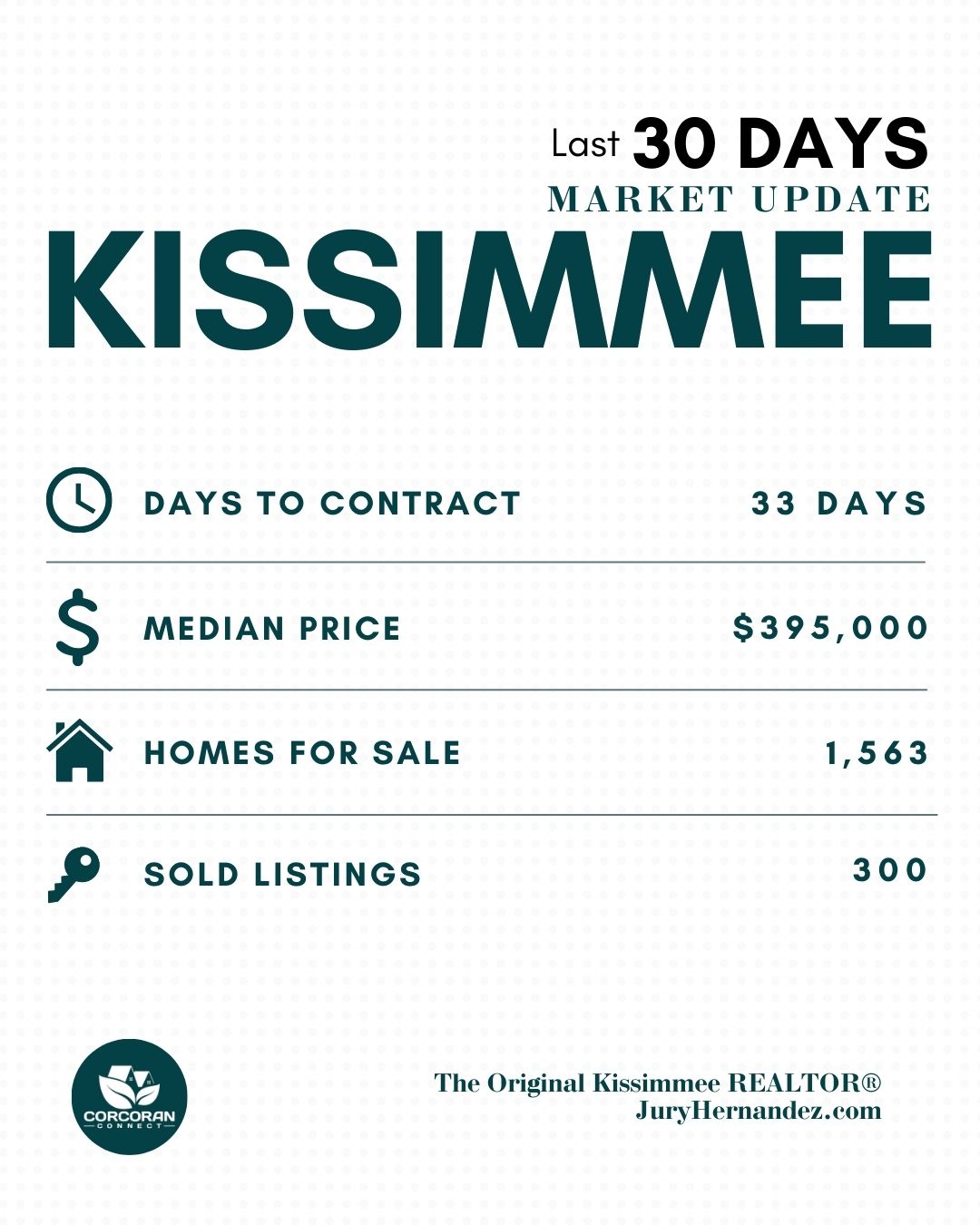

As a specialist in single-family homes, let's dive into the heart of Kissimmee's real estate landscape. At the moment, there are a whopping 1,563 single-family homes on the market, providing you with a plethora of home options to choose from. So, if you're feeling overwhelmed by the prospect of high-interest rates, let me assure you – optimism is the key. While interest rates may not be historically low, they are still within reach, especially considering the current adjustments in home asking price.

In fact, 664 homeowners have reduced their asking prices by an average of 7.23%, signaling a more dynamic and negotiable market. So, if you come across a home slightly above your budget, rely on your real estate agent (hopefully is me) to determine its fair offer price. There are opportunities waiting for you, and I encourage you to be optimistic.

The Buying Process: What You Need to Know

Now, let's talk about the exciting part – the buying process. Contrary to common misconceptions, people are actively buying homes in Kissimmee. In the last 30 days alone, 300 homes went under contract, and 285 homes were successfully sold. This is your evidence, your Swiss watch of comparable, showcasing the vitality of the Kissimmee real estate market. Just keep in mind that the winter market is usually slower because of the holidays.

Are you considering making an offer soon? In the last 30 days, homes took an average of 33 days to receive an accepted offer. This valuable insight emphasizes the importance of strategic planning. When a home hits the market, sellers may not be keen on aggressive offers unless they are motivated. Fear not; we have specialized strategies if you are looking to make a swift move. Reach out to schedule a consultation, and we can discuss your offer strategy.

Understanding Home Market Values and Pricing

Speaking of offers, sellers in Kissimmee are getting close to their list prices, with the fair market value averaging at 98% of the listed price. This indicates that homes are not being given away, but there's a balance that benefits both buyers and sellers.

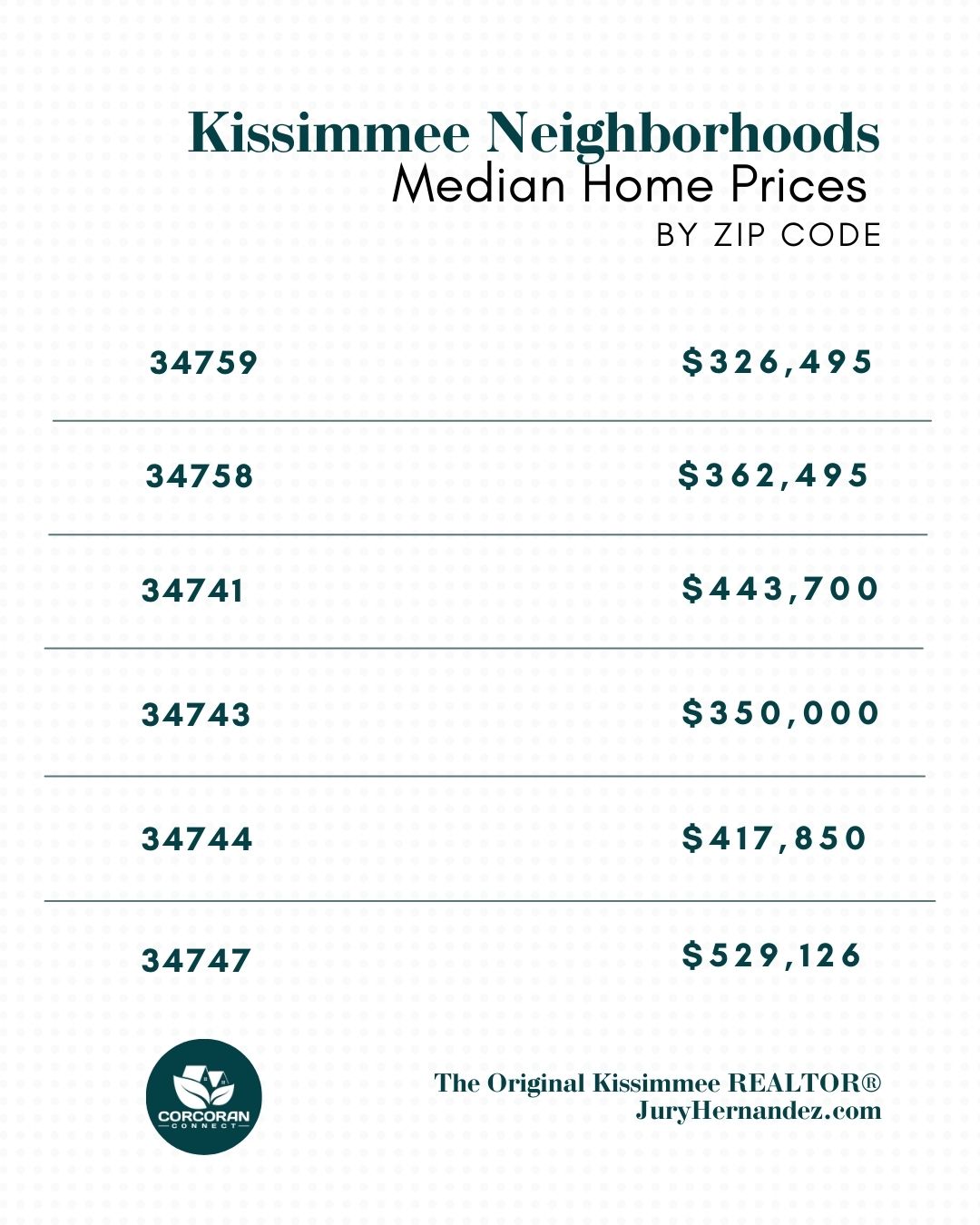

For first-time homebuyers, the median sales price for a single-family home in Kissimmee is $395,000. These homes typically boast 4 bedrooms, 2 bathrooms, and approximately 1,800 square feet under air. However, it's essential to note that prices and home sizes may vary depending on the ZIP code. If you have a specific area in mind, let's talk, and I'll provide you with realistic expectations tailored to your preferences.

Benefits for Buyers: Seller Credits and Market Stability

Despite the seemingly competitive market, there's good news for buyers. While sellers are not significantly reducing prices, many are offering credits. Out of the 285 homes sold recently, 163 sellers provided an average credit of $12,000. This demonstrates a shift in the market dynamics, with sellers recognizing the importance of offering incentives to attract buyers.

Moreover, Kissimmee's real estate market is proving to be more stable, with a surplus of inventory. Even if no new homes enter the market, the current inventory would take approximately 5.49 months to exhaust. This surplus creates a buyer-friendly environment, allowing for negotiations and added benefits.

Current Interest Rates

If your sights are set on making that dream home yours in 2024, you might be eyeing the current interest rates and thinking, "Whoa, they're a bit high!" Let me throw a little perspective your way – we're emerging from a time that'll go down in history where interest rates were practically handed out like candy. I'm talking historically low, folks! So, yes, we're in the sevens now, but rewind to the '80s, and you'd be staring at a whopping 18%. Suddenly, that seven-ish interest rate doesn't seem too shabby, right?

Now, here's the deal – your interest rate isn't etched in stone. It's shaped by your credit score, income-to-debt ratio, and guess what? You can actually do something about it. Tackle those small credit card bills, stay on top of your payments, and don't be shy to ask for that well-deserved raise at work. The worst they can say is no, right? So Start with the basics.

Home Buyers F.A.Q.s

Will Housing prices go down in Kissimmee in 2024?

You might have heard a lot of chatter about the market lately, with predictions flying left and right. But here's the scoop: prices generally take a hit when the national economy does a somersault. But hey, don't hit the panic button just yet!

Guess what? Our labor market is flexing its muscles, and people aren't throwing in the towel on their beloved homes. Sure, life's a bit pricier these days, but our community is resilient, and we're holding onto our little slices of paradise.

Now, let's dive into Kissimmee. There's been a little dance between supply and demand—a tango, if you will. It might lead to a slight dip in prices, but fear not, we're not talking about a market crash here.

Is Kissimmee a Buyer's Market or Seller's Market?

Great news for homebuyers in Kissimmee! The market is leaning in your favor. With a whopping 1563 single-family homes available, you've got choices. Sellers are adjusting prices (about 7.23% on average), signaling flexibility. Homes are taking around 33 days to get offers, giving you time to weigh options. Plus, seller credits are on the table (163 sellers offered an average of $12,000). It's a buyer-friendly scene, and with a bit of credit score TLC and maybe a raise request at work, you're in a sweet spot.

Note: We are officially in a stable housing market.

Seizing Opportunities: Your Path to Homeownership

In conclusion, the Kissimmee real estate market is brimming with opportunities for aspiring homeowners like you. I encourage you to take advantage of my offer for a free homebuying consultation. Together, we can navigate the intricacies of the market, answer your questions, and draft a personalized plan to make your dream of homeownership in 2024 a reality.

Feel free to check my schedule at the bottom of this article and book your consultation. The journey to homeownership begins with informed decisions, and I'm here to guide you every step of the way.

Happy house hunting!